Blog

Balancing Financial Wellness and Mental Health

Recognise the Interconnection: Everything starts with introspection. Financial stress impacts mental well-being and vice versa. Acknowledging this (to yourself) can help you work on solutions and encourages conversations, which reduce...

Achieving Success with SMART Goals: Personal and Professional Growth

Understanding SMART Goals: SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. This framework provides a structured and comprehensive method for goal-setting, enhancing clarity and effectiveness. Specific: The first...

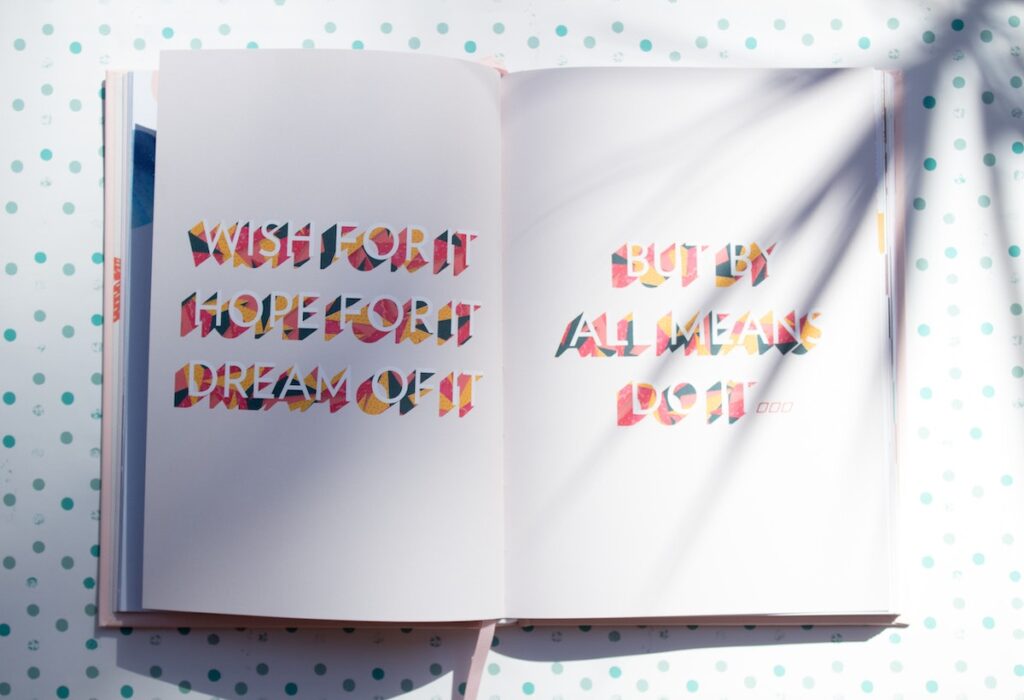

Setting goals for you and your business in 2024

The new year is a new beginning. If you are a business owner, this is often the time of year when you reflect on where you are at and think...

Financial Strategies for Freelancers and Remote Workers

Understand the Tax Landscape Australia's tax system is meticulous, and freelancers should be well-versed in their obligations. Familiarise yourself with the Australian Taxation Office (ATO) guidelines, including the Goods...

Understanding Your Credit Score

What is Credit Score: Your credit score is a numeric representation of your creditworthiness, typically ranging from 300 to 850. The higher your score, the more financially trustworthy you appear...

The Power of Knowing Your Net Worth

What is Net Worth? Your net worth is basically the difference between your assets and liabilities. Assets include everything you own, such as cash, investments, real estate, and personal belongings....

A Year in Review: My 2023 Growth Journey

Accepting Change: One major lesson that keeps on cropping up is that change is just part of life. When things get unpredictable, it's better to just go with the flow...

Holiday Time Management: Your Friendly Guide to a Joyful Season

Make a List and Check it Twice: First things first, let's get organised! Jot down all the tasks you need to tackle before the holidays roll around. Think gifts, decorating,...

How much should you pay yourself?

Being the boss means you get to make all the big decisions about your business – including how much to pay yourself in wages, salary or drawings. As the owner,...

The ATO agent nomination process

Because you are a new client, or your existing service arrangement with us has changed, you will need to nominate us as your official agent with the ATO - so...