You will need to lodge a Business Activity Statement (BAS) if you are registered for Goods and Services tax (GST). The purpose of the BAS is to:

- Report on several tax regimes (listed further below)

- Report income and some expenses

- Ensure businesses are regularly paying their various taxes up front, on a regular basis, rather than be hit with a huge bill at the end of the financial year.

The various taxes reported are explained in brief below, but if you want to know more, read my blogs “The most common taxes explained” and “Other taxes you may be charged”:

- Goods and Services Tax (GST): a tax on sales and purchases (conditions apply)

- PAYG Withholding tax (PAYGW): income tax withheld from employees, directors and office holders gross wages. Sometimes also withheld from payments to contractors under a voluntary agreement. This helps them meet their future tax obligations.

- No ABN Withholding: if a supplier doesn’t give you an ABN, you are required to withhold tax at their marginal rate (the highest income tax rate) and submit it to the ATO.

- Other amounts withheld: certain interest, dividend, unit trusts and other investment distributions where the recipient hasn’t provided a tax file number declaration or is a non resident.

- PAYG Instalment (PAYGI): income tax withheld to help the company meet their future tax obligations.

- Luxury Car Tax (LCT): tax on the import of a luxury cars over a certain threshold

- Wine Equalisation Tax (WET): tax for wholesalers or importers of wine

- Fuel Tax credits: credits on the tax component of fuel for eligible tax payers

- Fringe Benefits Tax (FBT): a tax on Fringe Benefits. Fringe Benefits are things the employer provides to their employees or the employees associates that are considered of a private nature. Examples include providing a car for personal use, membership to clubs or gyms, paying entertainment related expenses, paying for housing

Depending on the size of your organisation (and your preference), your reporting and payment period for the BAS can be monthly, quarterly or yearly. The information provided below assumes you are lodging BAS electronically because the Tax Department has worked very hard to phase out the paper BAS.

Monthly BAS:

- is due on the 21st of the month following the reporting period. For example, the BAS reporting February’s transactions is due on 21 March (or the next business day after the 21st).

- Is compulsory for business whose GST Turnover (effectively your GST exclusive sales) is $20 million or more.

- Is voluntary for business with a GST Turnover of less than $20 million. Several of my clients have elected to do a monthly BAS as it means that they can pay smaller amounts every month instead of a larger amount every quarter.

Quarterly BAS:

- Is the default for businesses with a GST turnover of less than $20 million

- Reporting periods are

- 1 January to 31 March

- 1 April to 30 June

- 1 July to 30 September

- 1 October to 31 December

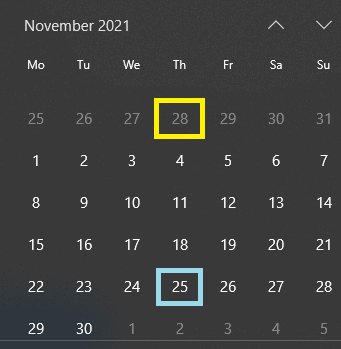

- Is due 4 weeks after the 28th of the month following the reporting period. “WHAT?” I hear you ask. I know it sounds weird! Historically, the quarterly BAS was due on the 28th of the month following the reporting period (or the first business day after the 28th). However, if you lodged online, you received an extra 4 weeks to lodge. So when reporting the 1 July to 30 September BAS , you can see in the calendar below:

- Paper BAS due date is 28 October (in the yellow square)

- Online BAS is due 4 weeks later, which is 25 November (in the blue square)

Annual BAS:

- Is only allowed if you voluntarily registered for GST (for instance your GST Turnover is less than the threshold of $75,000 or $150,000 for not for profits and you are not carrying passengers for a fare such as taxis or ride sharing service)

- Is not allowed if you are using the deferred GST scheme (such as when you are importing goods into Australia)

- Is due on 31st October for the financial year ending 30 June

- Is my least favourite way of lodging because it can catch some businesses by surprise and then they are scrambling to catch up with their bookkeeping and may not have the money available to pay their taxes.

You will be surprised how much easier compliance can be when you get the right advice.